Consumption & Savings - US & China compared

It is often argued that China needs to unleash its consumers in order to rebalance its economy. This article gets under the lid of the savings and consumptions statistics in the US and China and attempts to compare what is going on in order to test this argument.

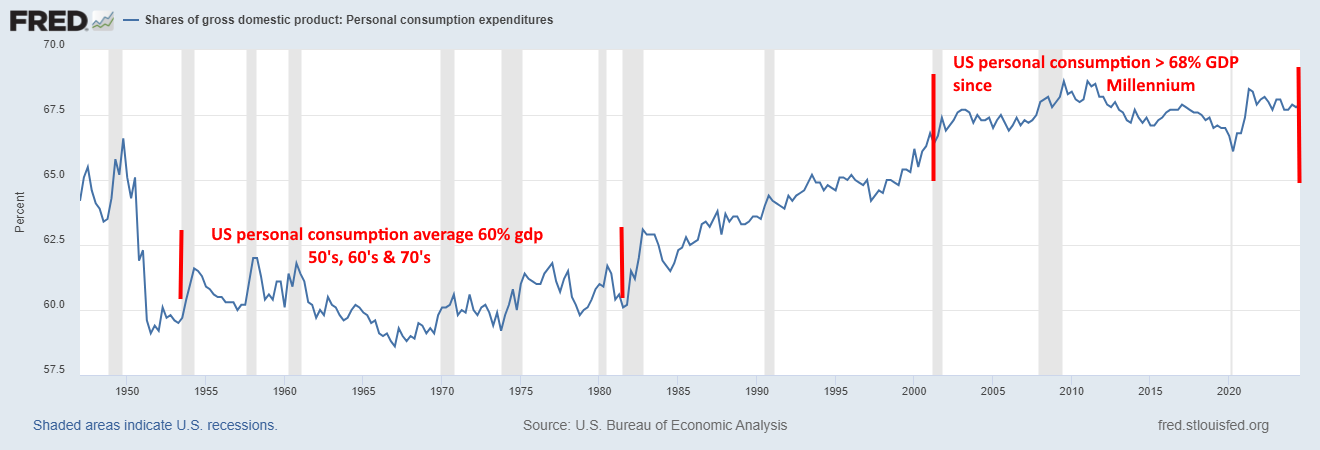

The graph below from Fred shows US personal consumption expenditure at 68% of GDP in 2023, which is similar to the level since the Millennium. In the 1960’s and 70’s the personal consumption expenditure level was around 60% of GDP and then rose steadily through the 1980’s and 90’s. Health expenditures are similarly around 10% of GDP higher than in the 1970’s so it is fair to say that the increase in personal consumption expenditure is directly related to the rise in health costs.

There is no inherent reason why healthcare expenditures should have increased so rapidly over the decades. The underlying causes are vested interests, legal drift and political inertia. However, the corollary of higher personal consumption expenditure is reduced savings and investment and an ever widening trade deficit as the demand for goods is met from abroad.

In 2023 the personal savings rate in the US was 4.4% of GDP which is about 10% of GDP too low (note there was a spike in savings in 2019/20 due to Covid).

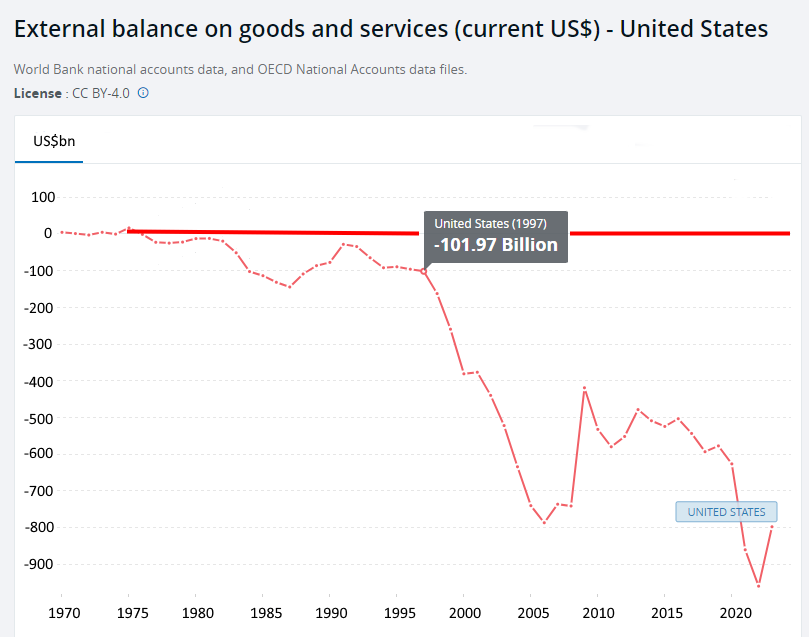

Since around 1980 the US has been running ever widening trade deficits with the rest of the world.

China spends 6-7% of GDP on healthcare and life expectancy has caught up to US levels in recent years.

China’s life expectancy was disastrously low in the years following the Great Leap Forward (mass collectivization of agriculture) but then recovered.

Whereas an exact comparison with China is complicated by different methodologies the chart below derived from China’s national statistics shows personal consumption expenditure at 39% of GDP, which is almost 30% below the US level but China is undergoing a vast investment boom, reflecting its catching up, with Gross Capital Formation of 42% of GDP.

Note that the Peterson Institute of International Economics add Social Transfers in Kind of 6% of GDP to Personal Consumption Expenditure which would give a figure of 45% of GDP for 2023.

Is China such an outlier? The chart below shows that South Korea, whose manufacturing companies are known for their voracious investment and innovation, also has a very savings ratio. In fact, it is the US and the UK who are saving too little and, as a bi-product, whose manufacturing companies are investing too little.

The table below attempts to compare the main categories of expenditure for households in the US and China, as a % of total household expenditure. Note that the Chinese spend a higher share of total expenditure on food, clothing and housing, a similar share on transportation and lower shares on health, education and household goods.

A few points to note:

China has a universal State healthcare system which covers about 60% of total costs whereas in the US households incur significant insurance and out of pocket expenditures

China clamped down on private tutoring for children of school age a few years ago as it was leading to unhealthy competition and its higher education system is mostly State funded

The other striking difference between the two countries is in Financial & Professional services. One assumes that this sector is still underdeveloped in China and people mostly save with their local bank. Or another way of putting it is that US consumers are being fleeced by commissions and fees whereas the Chinese live in a simpler world.

This table compares household spending and savings based on official data:

Household disposable income in 2023 was 41.50% of GDP in China and 51.89% of GDP in the US.

China’s households spent 68.33% of disposable income whereas US households spent 95.60%

China’s households saved 31.67% of GDP whereas US households saved 4.40% in 2023

It is fair to say that US households under-save by about 10% of GDP.

So if China’s households are saving so much what are they missing out on? The table below, from official data (stats.gov.cn) shows ownership rates of common consumer durables. A few points to note:

Car ownership is well below US levels but one could argue that the US is over dependent on cars and that public transport is far more developed in China. Also, in terms of car ownership China is catching up from a low base.

Motorbike and electric bike ownership is far higher in China than in the US.

China’s households have their full compliment of other durables except perhaps for personal computers

In the US average house size is considerably higher than in China

It is a regular feature of Western commentary on China that it needs to unleash consumption in order to “save” its economy. I think the economists who make such statements such try to itemize what exactly they think China’s households should be spending their money on as it is not very clear what they are missing out on.

Commentary

Some of the more common criticisms of China’s economy are that it consumes too little and that it will get old before it gets rich. However, we have seen above that South Korea has similarly high rates of investment and it has, in fact, a worse demographic profile than China with the world’s lowest birth rate but doesn’t attract the same kind of negative commentary. If a country spends on investment goods rather than consumer goods then that is a reflection of the trajectory it is on.

China recently scrapped its one child per family policy and there is no doubt that increased family size will lead to high personal consumption and reduced savings. However, it remains to be seen how quickly the cultural shift back to having more children can be achieved.

China’s prosperity is newly achieved and the Chinese have a fairly recent memory of when they were down. Thus, there will be a lingering feeling of insecurity and this leads to a propensity to save. One imagines that most Chinese today consider their consumption to be prolific compared to the previous generation who lacked for everything except the most basic goods.

The US over-consumes and needs to fix its healthcare system and this is the underlying cause of its external imbalances.